Bitcoin is a SCAM – The Alternative Perspective

Reading this article will require a strong mind and should challenge your perspectives on Bitcoin and the crypto industry.

If you choose to read and carefully consider the information, you may become a successful investor.

However, if you prefer to maintain your current beliefs, this article may not be for you.

Plan B’s Bubble Burst

Initially, I had immense faith in Plan B’s stock-to-flow model and shared the widespread belief amongst many others in the crypto community that Bitcoin would surpass 100k in the last cycle.

However, despite my conviction, I also possessed the ability to think independently and recognise that Bitcoin had likely peaked in April 2021 at 64k. Consequently, I sold and stepped away.

I returned eighteen months later, shortly after the FTX crash - confident that it presented a fresh investment opportunity. I placed some buy orders at 16.5k. My confidence to do this against the sentiment was, quite frankly made easy due to the numerous indicators and TA data sets I’d been following.

Facts or Fiction

Over time, my experience has led me to some eye-opening revelations regarding the crypto industry. It projects itself overall as a solution, a way to escape from the perils of fiat money and the central banks. However, the truth is far from it.

Chances are, you too view Bitcoin as a groundbreaking technology that will transform the world - a new-age store of value, or even internet gold. It is now imperative to broaden your horisons and look beyond the smokescreen.

Bitcoin is a fabrication and its narratives are fiction.

The Upside

Since ancient times, humans have exhibited a tendency towards taking calculated risks, whether it pertained to survival in the past or financial risks in the present. Such risks bear the potential for significant rewards, and greater risks can translate to greater rewards.

The New York Stock Exchange dates back to May 17, 1792, when 24 stockbrokers signed the Buttonwood Agreement as a response to the nation's first financial panic, marking the inception of a new means of wealth creation through investing in specific companies. The better the companies perform, the better the investments do, thereby creating wealth through the risk of betting that a specific company will continue to perform well.

Bitcoin originated as a decentralised, peer-to-peer monetary system backed by a unique and novel Blockchain network. However, it quickly transformed into something entirely different. Despite its original purpose, Bitcoin has proven to be a poor medium of exchange given its continual volatility, which is detrimental to consistency in purchasing. Although I accept this might change in the future, there are zero guarantees.

But yet - there are two factors that make Bitcoin exceptionally appealing for me: the potential for unprecedented returns and its effective Ponzi-like design.

Let me be clear: the individuals who make significant profits in the world of Bitcoin and crypto do not subscribe to the frivolous narratives.

They are playing a game, and unfortunately, if you subscribe to the general narratives, you are the loser.

Bitcoin operates on sentiment cycles. The savvy players take advantage of these cycles, buying when others think it’s foolish to, and selling when everyone believes the price of X coin will go up forever.

‘Bitcoin will never stop going up’

In contrast to the stock market, you're not investing in a company that has inherent value since it creates things. Instead, you're betting that someone else will buy your coins at a higher price than what you paid for them.

It's fuelled by greed, not by the halving.

Greed cycles are now driving the Bitcoin price, and you can only profit if you take advantage of someone's ignorance - or gambling addiction - by selling it to them at the top. That individual will lose money, and you will benefit from it. That's how you, and I, win.

Over time, there have been ideologies created in the industry by scammers such as the concept of HODLing (hold-on-for-dear-life) and WAGMI (we're-all-gonna-make-it). These stories couldn't be further from the truth.

The truth is, you're in competition with people like me who study the data and wait for others to sell their coins to me at a loss, only to sell them to someone else at the top who will hold those coins at progressively deeper losses until they can no longer bear it.

They want you to believe that HODLing is an effective strategy, saying things like "Bitcoin has yet to see mass adoption, S-curve, super-cycle." You believe you're intelligent by HODLing, but you've fallen into their trap.

Consider this: you've been told that fiat money is a corrupt system that takes advantage of you. You should accumulate as much Bitcoin as possible, buy at any cost, and never sell.

It's highly effective. Those who do this increase the price indefinitely. And this allows the big players to sell to those who will purchase at any price and off-ramp into fiat to buy things that make their life better or easier.

However, the truth is that fiat is an essential part of daily life, whether or not you agree with the inflation system. It allows you to eat, drink, and have a roof over your head. Everything essential to life is dependent on it.

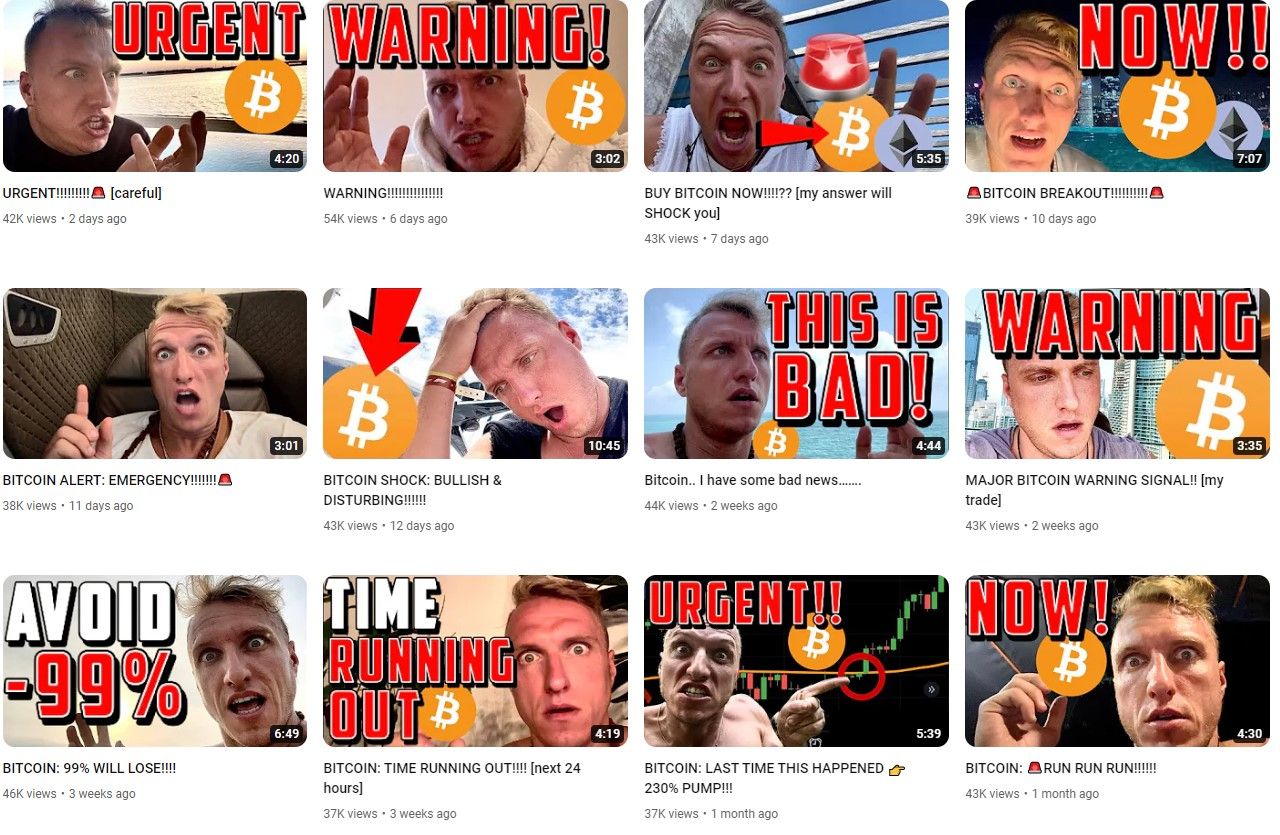

cRyPtO influencer scams

The crypto industry has captured significant attention which has driven an increasing number of bad-intended-individuals who see opportunities for financial gain – at your cost.

Unlike them, I aim to provide helpful insights rather than simply promoting it relentlessly without care of the consequences.

Unfortunately, the crypto industry often rewards individuals who tell people what they want to hear rather than those who provide genuine help. These so-called "crypto influencers" often have over a million followers and promote buying crypto, specifically Bitcoin, even when it may not be wise to do so.

Their followers trust them blindly; not because of their accuracy, but because their messages make them feel good. It’s all about psychology. During the last market peak, many of these influencers were shouting that Bitcoin would inevitably reach $100k, urging people to buy in. This was mainly to increase their own profits rather than to help others.

Sadly, many who followed this advice ended up losing significant amounts of money when the market crashed. While some influencers apologised, most refused to acknowledge their role in these losses and continued to push their advice.

It's essential to think critically and avoid blindly following the advice of crypto influencers.

Something is off

Something seems amiss with Bitcoin. Despite the stock to flow model predicting 100k and the S2FX forecasting 250k during the last cycle, Bitcoin fell short at 69k. Many try to justify this by citing factors like paper Bitcoin in the system - but the numbers show that returns are diminishing.

The greatest Ponzi-scheme in the world cannot continue indefinitely.

People are getting smarter. Those who were hurt and misled in the last cycle are out for revenge and ready to take profit. There are more of them than ever before, making it increasingly difficult for early investors to profit from those who buy at prices over the all-time high.

Now, you have to convince people to buy something worth $70,000, which is a challenging task.

Despite the argument that ‘you don't have to buy a whole Bitcoin’, many still want to do so, even if it means buying coins worth less than a cent to give them an illusion of ownership – i.e. buying shitcoins.

It's highly probable that there isn't much time left to take advantage of Bitcoin cycles, as it becomes more difficult to persuade people to either repeat past mistakes of buying at high prices or to convince new investors with little knowledge of Bitcoin to buy. This makes the future of Bitcoin uncertain.

The reality check

It's time to face the truth: you're not an early adopter of Bitcoin.

Technology evolves rapidly - and eight years ago, or more, was ‘early’ in Bitcoin. You might hear people boasting about how much they would have earned if they had bought Bitcoin at $10, but that ship has sailed, and even those who made a fortune from it aren't holding on to it now. Time is running out.

The more emotionally invested you are in your investment, the more likely you are to make bad decisions and have a distorted judgment.

Bitcoin has a way of triggering emotional attachment in people, more than any other investment in history. Fear and greed keep the cycles going.

Bitcoin is not a world-changing technology, it doesn't outperform the dollar, and it's not guaranteed to reach a million or even 100k. You have been fed with lies that you might defend until the end of time.

Many people won't tell you these things, as it hurts adoption, which hurts their wallets and their crypto empires. I am different. I speak the truth, no matter how harsh, because I care about your success.

My success comes from my inverted psychology, which doesn't align with the masses. I get excited when Bitcoin dips low on news because it's a buying opportunity, and I get worried when it skyrockets because it might be overpriced. I welcome those who disagree with me because it makes me more convinced that my decision is probably right.

My mission is not to be right, but to make informed decisions based on long-term data, and be happy with the outcome. Bitcoin is a tool, and I am patient. I know when it's optimal to buy or sell, and I will wait for the right time. When those times come, I will act decisively and let you (my Twitter followers) know. Make sure you are following @Coinconomics_.

The more you listen to stories about Bitcoin, the more programmed you become, the more emotionally attached to your investment, and the more likely you are to never sell. You'll become another cog in the machine that vacuums all the money you willingly give it.

Bitcoin is not the truth, and you need to know the reality. Thanks for reading. It might be a bitter pill to swallow, but it will make you a formidable investor.

Good luck! Follow @Coinconomics_ on Twitter for more.