The Unfair Advantage: Bitcoin is Stacked Against You

In this article, we dive deep into the behind-the-scenes world of Bitcoin and explore why it's not comparable to the stock market.

The unique cycles of Bitcoin have caught the attention of many investors, but time is running out to take advantage of them.

We also discuss the 4-year cycle and how to rig the game in your favor.

While the information presented may not always be pleasant, it's important to focus on the truth to make informed decisions and ultimately profit from this exponential asset.

Behind the Scenes of Bitcoin

The underbelly of the Bitcoin industry is not often discussed, but it is important to shine a light on the questionable activities taking place behind the scenes.

The influence of the meme community on Bitcoin's price cannot be denied, especially with the rise of meme coins like DOGE, SHIB, and PEPE.

It is hard to forget the last All Time High for Bitcoin, which coincidentally hit $69,000, a number that holds significant cultural significance.

It begs the question, how much influence does it take to make this exact Bitcoin top, on the dollar? It's quite tremendous.

The humor associated with meme culture is typically attributed to a younger generation, which leads to the assumption that the people behind the scenes influencing Bitcoin's price are likely a group of young individuals who have either amassed an unprecedented amount of Bitcoin early on, or possibly even the creators of Bitcoin themselves.

Many people consider Bitcoin to be a serious long-term investment and separate it from meme coins by citing its true value.

However, we need to ask ourselves if we are sure about that.

Bitcoin's specific technology can now be replicated, and there is nothing inherently great about it.

Its greatness is often attributed to its anonymous creator, Satoshi Nakamoto, but how much Bitcoin does this creator have, and how much have they distributed in their network? These are all unknowns.

The reality is that you are playing a game, and it is rigged to provide profit to those that take advantage of the cycles of fear and greed and ride the backs of those that falsely believe in the savior-like image Bitcoin portrays.

It transfers money from those who do not understand Bitcoin's cycles to those who do.

Coinbase, one of the world's largest exchanges, has been known to shut down operations at convenient times, particularly during large Bitcoin market drops and rises. This cannot be a coincidence.

By halting trading activity during convenient points, Coinbase can move around their own coins before resuming the common folk's activity. It's a suspect practice.

The tops and bottoms for Bitcoin have been marked by major internal events, such as the FTX collapse in November 2022, the Coinbase IPO in April 2021, and Bitcoin's listing on CME futures in December 2017.

These could be conspiracy theories, but organized scheming takes place with many other cryptos, so why not Bitcoin?

The sad truth, in my view, is that Bitcoin is a meme coin, just like DOGE, SHIB, and PEPE.

People tend to turn a blind eye to this effect because Bitcoin is the most popular crypto, the first and the one that gained the most popularity.

The biggest difference that separates Bitcoin from other coins in people's minds is its price action.

Over time, Bitcoin has been profitable, much more so than any other investment in history consistently. However, that time is growing shorter, as we will discuss later in this article.

The stock market is also rigged, as we saw with the GameStop stock that turned into an alt coin for a brief period, causing trading platforms to halt activity due to "volatility." It's clear that much larger forces are at play that make the rules, and I do not think Bitcoin is an exception.

Why Bitcoin is Not Comparable to the Stock Market

Many supporters of Bitcoin often compare it to the stock market as a way to argue for its long-term investment potential.

However, it's important to note that Bitcoin and the stock market cannot be compared in a positive light for the former. In fact, there are significant differences in price action that set them apart.

While some people view Bitcoin as a hedge against inflation or a retirement plan, its effectiveness in those roles is debatable.

Many proponents of Bitcoin often counter this criticism with quotes from those who expressed doubts about the cryptocurrency early in its history. For instance, they may cite someone who regrets selling Bitcoin at $2.

While such hindsight bias may make these early naysayers look foolish, it's worth remembering that selling any asset early on could lead to the same regret.

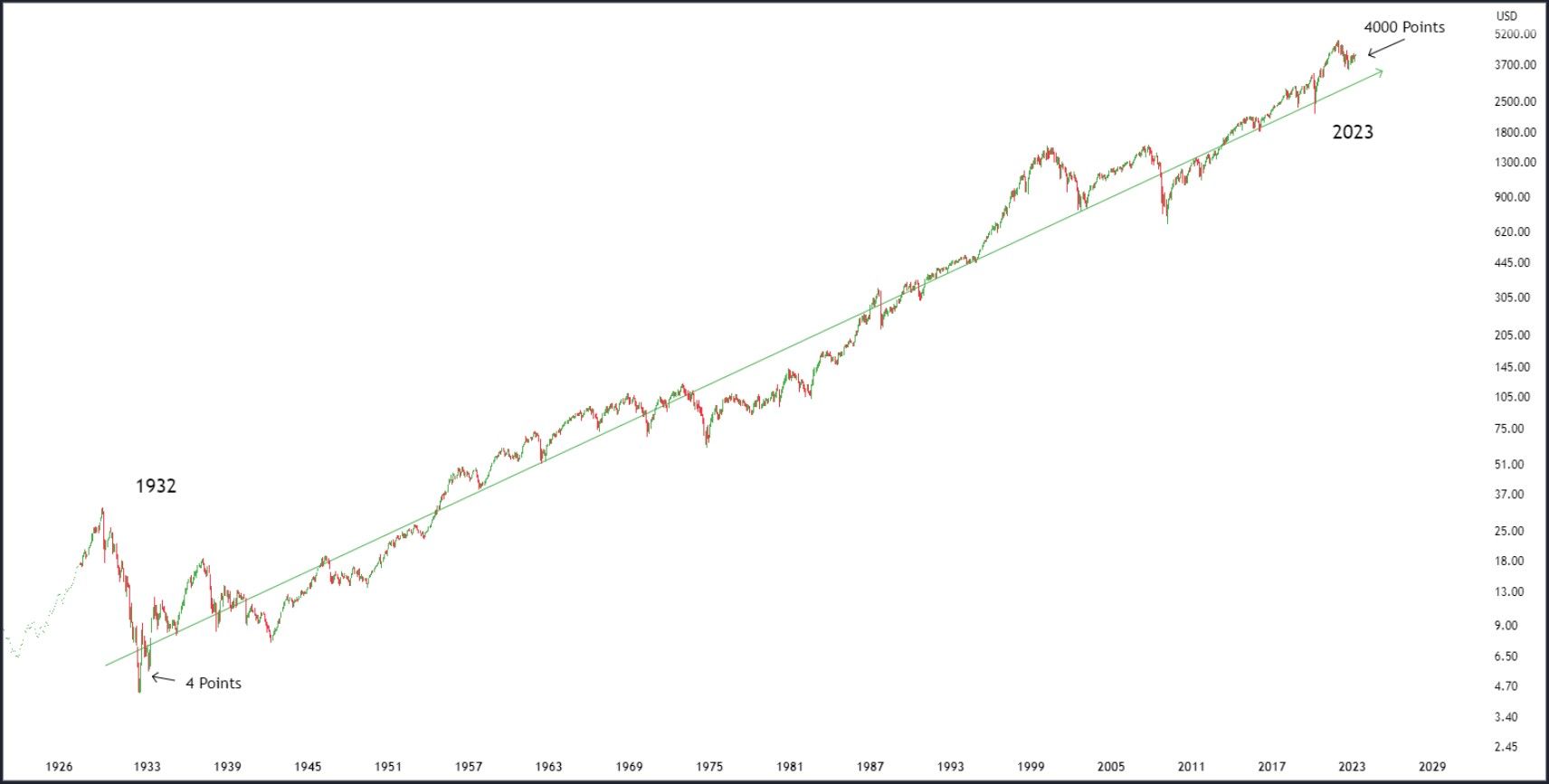

A comparison of S&P vs. Bitcoin (S&P chart first):

The S&P 500, also known as S&P, is a stock market index that tracks the performance of the top 500 companies in the US.

Investing in S&P can be done through index funds, which are designed to mirror the index's performance.

If you had invested in an S&P index fund when it was at 4 points, theoretically, your investment would have grown by 100x.

However, this would have taken a whopping 90 years, starting from the bottom of the Great Depression crash in 1932.

The steady gains of the S&P 500, year over year, make it a great example of consistent growth. Over the past 20 years, the S&P 500 has provided an average annual return of around 9%.

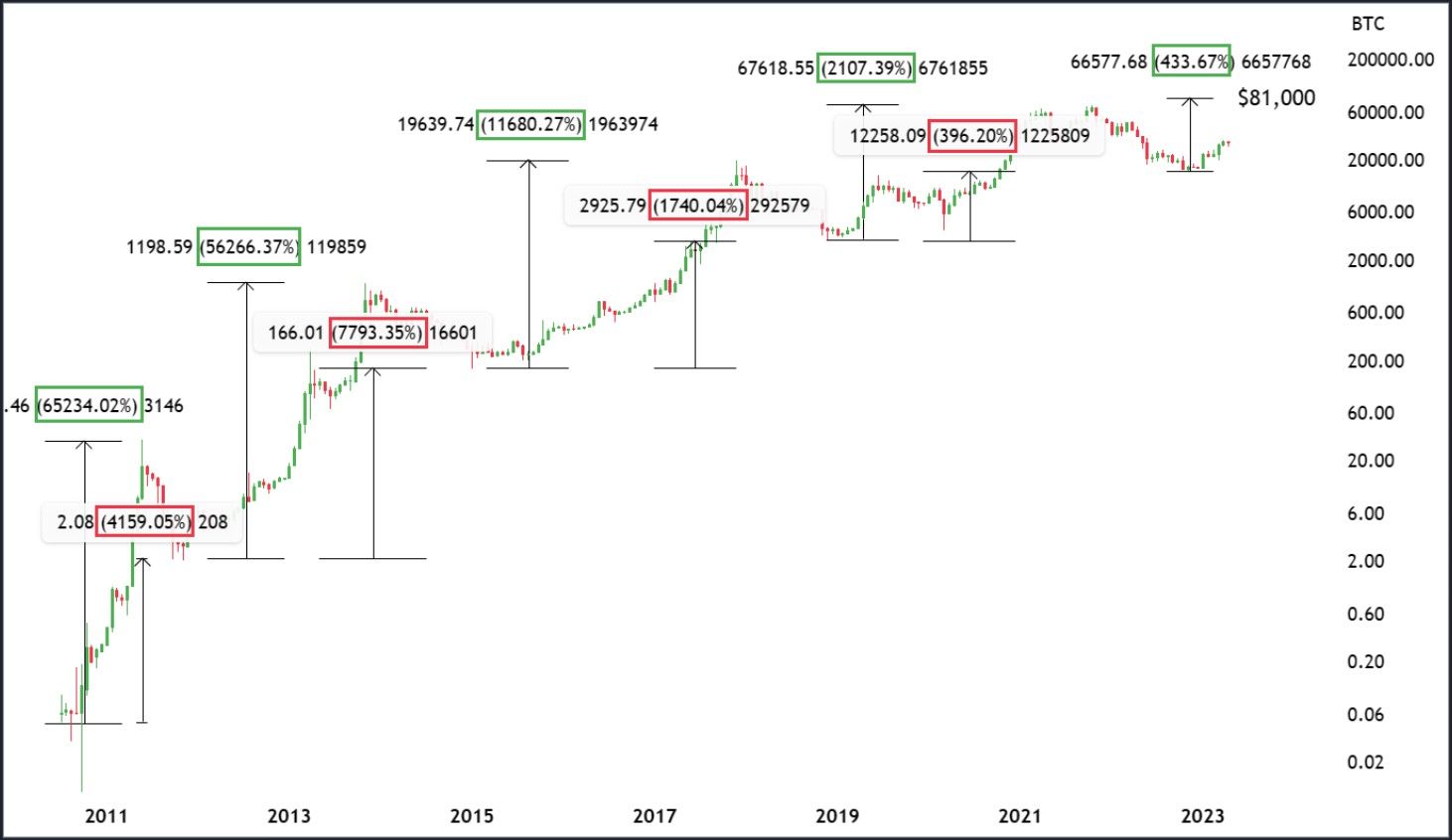

Now, let's compare this to Bitcoin:

Many investors make the mistake of comparing Bitcoin's price action to that of the stock market. However, Bitcoin is an entirely different beast. While the stock market provides consistent gains year after year, Bitcoin's gains are exponential.

The rise from $4 to $4,000 took only six years, from 2011 to 2017. It's easy to confuse exponential gains with consistent gains, but the two are entirely different.

Bitcoin is an asset that operates on a curve. While logarithmic curves can be fitted to its price data, they eventually flatten out, providing near-zero growth.

No asset in history has ever sustained exponential gains, and Bitcoin will be no different. The fact remains that, whether we like it or not, Bitcoin's curve will eventually flatten out.

Many long-term Bitcoin holders hope that mass adoption and inflationary hedge narratives will save them.

But, can you really base your future financial situation on a feeling? Feelings are not a reliable basis for financial decisions, and those who depend on them usually don't fare well.

Bitcoin provides gains to those who take advantage of its cycles, but that time is growing short.

The exponential gains that investors have enjoyed for years will eventually come to an end.

It's crucial to be aware of the facts of the chart, and not confuse exponential gains with consistent gains.

Time is Running Out for Bitcoin's Unique Cycles

Bitcoin's unique cycles provide a great opportunity to buy and sell at points of maximum opportunity.

However, because Bitcoin is an exponential asset and not a continuous one, you must understand that time is running out to take advantage of these cycles.

As returns diminish, greed, which has been the true driver of Bitcoin's adoption engine, will be extinguished.

The truth is that most people are not interested in the blockchain technology behind Bitcoin. They are here to make money, and Bitcoin has been a great way to do that.

However, as time goes by, this is becoming less and less true, which will naturally cause a decline in adoption for those who are only interested in monetary gain.

The price action clearly proves this.

Before we dive into the next chart, let's strip away the narratives that have been spoon-fed to us by the Bitcoin community.

Terms like "Bitcoin inflation hedge", "Bitcoin to 1 million", "Mass Adoption", and "Bitcoin World Reserve Currency" have been used to create a cult-like mindset to spur adoption.

Forget these narratives, even for a moment, and let's focus on the facts.

The chart above shows the Bitcoin price with two different percentage gains highlighted. We'll first take a look at the green percentages, which represent gains from bottoms to peaks of each cycle.

The numbers speak for themselves:

- 65,234% (652x)

- 56,266% (562x)

- 11,680% (116x)

- 2,107% (21x)

For the past two cycles, the percentage gains have been a fifth of the previous cycle.

If this trend continues, the peak of the current cycle will only see a 433% increase, resulting in a mere $81,000 peak.

It's time to remove emotions and look at this clearly.

Hoping for the world to adopt Bitcoin and make you rich is no different from lottery players dreaming of hitting the jackpot. Look at the data - returns are diminishing rapidly.

The percentage gains from lows to lows, highlighted in red, are important for those who believe in HODLing.

However, returns for HODLers are decreasing drastically as well.

If you bought all your coins at the exact bottom of the last cycle at $3,300, the gain to this cycle's bottom is only 400%.

While this is still a good return, it's important to note how rapidly it's decreasing.

In the next bear market, even buying at the best possible prices may not result in any profit.

Holding onto an exponential asset long term is not effective.

Don't use past returns to defend your position. It's time to break free from the mind trap that has been created.

The numbers prove that percentage returns are shrinking drastically.

So, what's the solution? Buying and selling according to long-term data.

This strategy has proven to be reliable, as evidenced by my own experience of buying two Bitcoin bottoms and selling near the last top.

Even if I'm wrong and returns don't diminish as expected, I still win because long-term data will pave the way for me to make the right decision.

It takes effort and courage, but it's worth it.

Hopefully, I can make it easier for you if you stay up to date with my analysis. If you're not already, follow Coinconomics_ on Twitter.

Buying at $16.5k when everyone was saying a recession is coming was difficult, as was selling at $54k when everyone was saying $100k was inevitable.

4 Year Cycle – How to Rig the Game in Your Favour

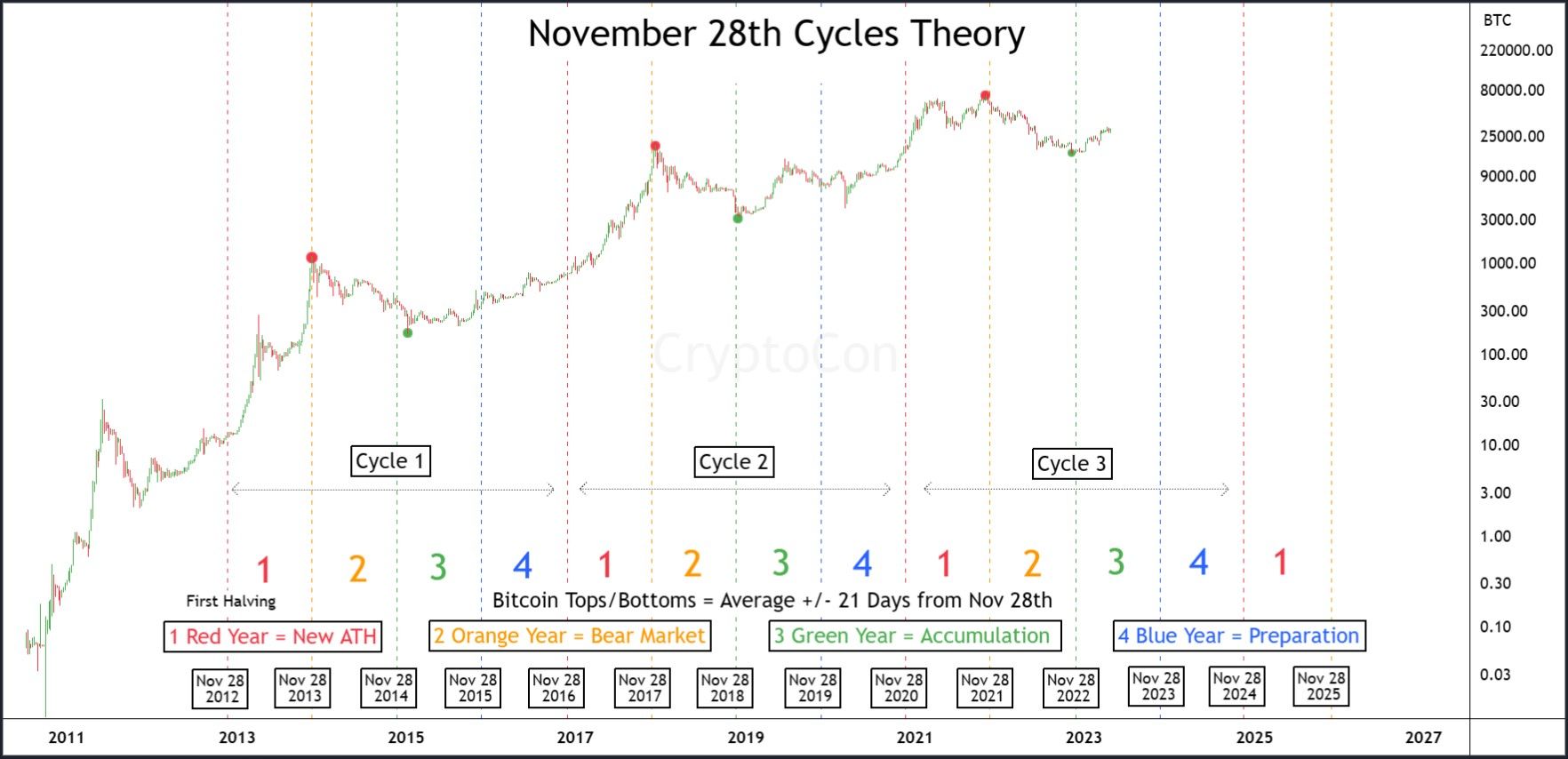

As I mentioned earlier, Bitcoin operates on a unique cycle of around-about 4 years, unlike the conventional stock market.

While many attribute this to the halving mechanic, where the reward for Bitcoin miners is cut in half every 4 years, reducing supply and driving up demand and prices, this explanation seems less likely now.

This is because the new supply introduced by miners is minuscule compared to the total supply, and the market requires a significant amount of money to move prices.

Therefore, I now believe that the primary drivers of Bitcoin's price and cycle structure are as follows

- World Liquidity (Total available liquid cash)

- The first halving

- Greed

World liquidity refers to the amount of money readily available in the world, which directly impacts how much Bitcoin can rise.

I do believe that the first halving played a role in affecting the Bitcoin price, as the market cap was relatively low back in 2012, allowing for a greater influence by the supply of Bitcoin introduced by miners.

Greed is a natural instinctive emotion in humans. At its core, it is about survival. We have evolved to be greedy so that we can survive more comfortably.

The November 28th Cycles Theory, clearly outlines these factors:

Following the first halving, a pattern around the specific date of November 28th emerged, which has proven to be a significant point for every cycle high and low, occurring at an average of approximately +/- 21 days from the date.

It is possible that this pattern could also be attributed to manipulation by those behind the scenes controlling price action to their own advantage, as previously discussed.

When there is enough world liquidity available, and the price of Bitcoin starts to rise, greed comes into play.

People hope for extreme price targets, leading them to buy over the all-time high and create new ones.

However, as the price becomes more difficult to move, it becomes harder to convince more people to buy the asset and push the price further up.

For example, many people said they would never buy over $20,000 during the last cycle, but billionaires like Kevin O' Leary still backed Bitcoin near the ATH.

The game now is to convince as many people with big money to make that mistake as possible, but diminishing returns indicate that it is becoming harder to do.

So, What's the Point?

Reading this may seem disheartening, but I believe in the truth, whether it's good news or bad. Ultimately, the truth is what helps people, not just telling them what they want to hear.

Some may accuse me of being a dollar maximalist or compare me to critics like Charlie Munger or Warren Buffet, or even to the early naysayers who missed out on a valuable asset. But that's not who I am.

I like Bitcoin and I use it. My goal is to make money and show others how to do the same.

If you're not interested in making money, then you probably won't be interested in what I have to say.

I've tuned out the Bitcoin maximalist community, which I once belonged to, and now focus solely on the data, which has been incredibly successful for me.

I encourage you to do the same because data can reveal the truth when nothing else makes sense.

There's still money to be made in Bitcoin, but time is running out.

Bitcoin is an exponential asset, and the logarithmic curve is flattening out. I hope I'm wrong and that returns keep increasing, but I'm staying level-headed and presenting insights based on reliable data.

You have a choice to make. Will you trust reliable data or just go with your gut feeling? It's entirely up to you.

Thank you for reading! I hope you found the information valuable.

Best of luck on your journey!

Follow Coinconomics_ for more